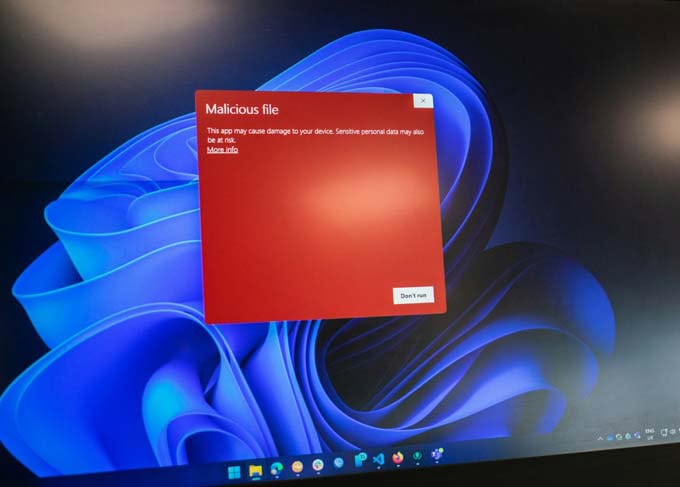

Internet-based white-collar crime as the dominant risk for Swiss companies

Gloomy forecast for the Swiss economy: more than 80 percent of the companies surveyed expect a significant increase in white-collar crime over the next twelve months. The main driver is cybercrime.

White-collar crime represents a significant and growing challenge for Swiss companies. While traditional crimes such as fraud, embezzlement and corruption are still present, cybercrime has become the biggest growth market - with higher growth rates than fraud and money laundering combined. These are the findings of a recent study by Lucerne University of Applied Sciences and Arts.

Particularly alarming: more than 80 percent of the experts surveyed expect very high growth rates in white-collar crime over the next twelve months. «White-collar crime not only causes considerable financial losses, but also undermines the trust of investors, customers and the public in the integrity of the companies concerned,» says Susanne Grau, author of the study and Head of Economic Criminology at the Institute of Financial Services Zug (IFZ) at Lucerne University of Applied Sciences and Arts.

Artificial intelligence: both a blessing and a curse

The expectation that artificial intelligence (AI) will provide valuable support in the fight against white-collar crime is only partially confirmed by the results of the study. The picture is differentiated and shows AI to be a double-edged sword: on the one hand, many companies recognize the risks associated with the increased use of AI - for example, AI makes it significantly easier to invent personal profiles and places of origin or to generate payment receipts that have never been recorded. Around 67% of respondents consider the risk of being affected by AI fraud attempts to be high. Only around 28 percent consider these risks to be low. «This discrepancy shows that there is still considerable room for improvement in some companies when it comes to raising awareness of the potential threats posed by technological advances,» analyzes Susanne Grau.

Risks of white-collar crime: hardly systematically recorded

On the other hand, the potential of AI to reduce risk is also recognized: Around 45% of participants see the increased use of AI as more likely or clearly an opportunity to minimize white-collar crime risks and detect incidents more quickly. The fact that more than 40% of respondents stated that they had already been affected by AI-induced fraud attempts in their company is particularly revealing.

The inadequate preparation of many companies is also a major cause for concern: Only around half systematically record risks relating to white-collar crime. «Every second company lacks knowledge about existing and new risks,» says Susanne Grau.

Source: www.hslu.ch