Less waste, more added value: the benefits of upstream closed-loop solutions

"Reduce, reuse, recycle" is a widely recognized motto of the circular economy. But these terms have very different meanings for companies and investors. Recycling is only the last resort in a circular solution, while expanding to upstream solutions can lead to better outcomes for the environment and portfolios.

Although recycling is important, it should never be seen as a model for the circular economy. This is because it is insufficient and inefficient compared to upstream solutions that prevent waste generation in the first place. The EU Commission, a global leader in promoting the circular economy, underlined its preference for upstream solutions when it found that 80 % of environmental impacts are due to decisions made at the design stage of product development.[i]

Recycling - an inadequate solution

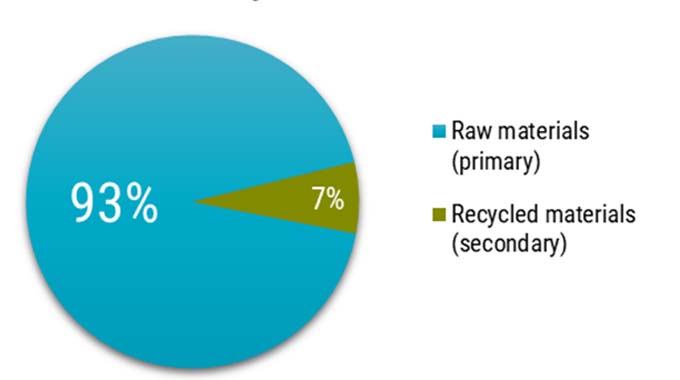

The proportion of recycled materials used in the global economy is currently around 7 % and continues to fall.[ii] This means that the majority of the material stock that is imported into the economy each year comes from new raw materials.

It is certain that legislative measures requiring a higher proportion of recycled material and industrial innovations in recycling technologies are increasing the impact of recycling and increasing its use in absolute terms. However, this is simply not enough to keep pace with rising production rates. Over the last five decades, the total amount of materials produced annually has almost tripled (270 %).[iii] Without a significant slump in demand, it is unlikely that recycling will ever catch up.

Figure 1 - New raw materials overshadow recycled material

Annual material consumption in the global economy. Raw materials that enter the economy from primary (new) sources far outweigh those that come from existing, recycled (secondary) materials.

Source: Circularity Gap Report, 2025.

Recycling is a costly, low-value solution. For many industries, the costs of recycling and recovery - collection, sorting, cleaning and processing - are too high. Recycled cullet or waste glass, for example, can be up to 20 % more expensive than virgin material.[iv] In the USA, the surcharge for recycled plastic compared to new polymers and resins is 25 %.[v] This is a decisive factor, as only 1 to 7 % of consumers are prepared to pay a premium for recycled materials.[vi]

And processing costs are rising as the material mixtures in the waste streams become increasingly complex. The limit value yield of multi-polymer plastics, textiles made from mixed fibers or multi-component electronics and machines is much lower than for simpler materials such as glass or aluminum. [vii]In addition, recycled materials are often inferior and less functional, further limiting their potential uses and commercial value.

Figure 2 - Recycled plastic is more expensive than virgin material (Europe)

The chart shows the price differences between two types of recycled PET plastic (food-grade regranulate and transparent flakes) and new PET plastic in Europe. Recycled plastics are considerably more expensive. In May, the price for food-grade regranulate was EUR 700/tonne, EUR 400 higher than for virgin PET regranulate. Food-grade regranulate is processed according to stricter quality standards and can be used for food or medicine packaging, for example. Transparent flakes are used as a base material for industrial applications with less stringent quality criteria.

Source: S&P Global Commodity Insights, June 2025

The power of upstream thinking

According to circular economy experts, waste and pollution are caused by faulty design.[viii] In a perfect circular economy, recycling would only be used sparingly, if at all. Circular solutions are best applied upstream in the design of the product and not at the end of the product life cycle. This means that durable, repairable, modular and biodegradable products must be developed.[ix] This also applies to companies whose innovative technologies enable their customers to use resources more intelligently and achieve more with less.

Examples of wides Sector commitment

- Technology and industry - Although Cloudflare and the Ashtead Group operate in very different industries, both promote the circular economy through shared platforms that replace on-site asset ownership with on-demand access. Cloudflare leases cloud computing and networking infrastructure to remote locations, eliminating the need for individual companies to build their own data centers.

The Ashtead Group rents out industrial equipment, from scaffolding and work platforms to conveyor belts and power tools. Product sharing models increase asset utilization and product longevity through centralized maintenance. More importantly, they help an economy do more with fewer resources, reducing the need for physical assets across the economy.

- Manufacturing and construction - Celestica and Cavco are two outstanding companies that offer joint manufacturing services for various industries. Cavco focuses on prefabricated homes, where scaled and optimized manufacturing and assembly in the factory significantly reduces the excess material of on-site construction.

Celestica manufactures electrical components in joint production for customers in the aerospace, energy systems, medical devices and diagnostic equipment sectors. Strict manufacturing efficiency and tighter control of supply chain logistics help to reduce resource consumption. The modular design promotes the maintenance and repair of products, thereby extending their service life.

- Consumer staples and basic materials - Sprouts Farmers and Sensient are good examples of circular solutions in the food and agricultural sector. Sprouts is a supermarket that focuses on fresh, organic and locally grown produce. Less packaging, chemical preservatives and transportation means less overall emissions and a smaller environmental footprint compared to processed food or meat alternatives.

Sensient focuses on supplying customers in the food, cosmetics and pharmaceutical industries with colors, flavors and specialty ingredients that are naturally regenerative and derived from plants and organic sources.

- Health and environmental services - Halma and Galenica are examples of how circular solutions are used in the health and environmental sector. Halma develops safety, health and environmental monitoring technologies - from pure water sensors to fire detection systems - that prevent risks and extend the useful life of facilities. With its own pharmacy network and logistics, Galenica improves access to medicines while eliminating inefficiencies and waste in the healthcare sector.

Wide-ranging commitment

Too much focus on downstream recycling and waste management companies narrows the investment universe and limits the capture of attractive opportunities across the industry's value chains. Expanding the portfolio to include upstream solution providers not only increases the portfolio's return potential, but also diversifies the portfolio's exposure to various style factors, including high-growth innovation, high-quality cyclicals and defensive industry giants (see Figure 3).

Figure 3 - Balance between growth and stability

The focus on upstream solutions expands the investment universe across different sectors and growth cycles and increases the return potential and long-term robustness of the portfolio in different market environments.

Source: Robeco, as at September 2025.

By shifting away from recycling and towards upstream solutions, a broad range of industries and companies with compelling business models and growing market shares can be tapped into. This not only strengthens the portfolio's potential to generate sustainable returns, but also creates the opportunity to invest in companies that deliver greater value in terms of circularity and environmental impact.

Important noteThe companies shown are for illustrative purposes only and are indicative of the investment strategy as at the date shown. The companies are not necessarily part of the strategy and their future integration is not guaranteed. This is not a recommendation to buy, sell or hold, nor should any conclusions be drawn about the future performance of these companies.

Notes:

[i] EU Commission, State of the Union speech, Circular economy, retrieved in September 2025.

[ii] Proportion of recycled materials: 6.9 % compared to 9.1 %, Circularity Gap Reports 2025 resp. 2018.

[iii] Volume of material production: 27 billion (1970) compared to 106 billion tons (2025). Circularity Gap Report, 2025.

[iv] "Distributors are at the center of circular solutions." BCG, November 2022.

[v] "Impact on virgin vs recycled plastics." Briefing Note. Institute for Energy Economics and Financial Analysis, November 2024.

[vi] "Consumers are the key to taking green mainstream." BCG, September 2022.

[vii] US General Accountability Office (GAO), Textile Recycling Technologies. July 2024.

[viii] Ellen MacArthur Foundation, Eliminate waste and pollution webpage. Retrieved September 2025.

[ix] Ellen MacArthur Foundation, The technical cycle of the Butterfly Diagram. Retrieved September 2025.

Author: Natalie Falkman is a senior portfolio manager at the asset management company Robeco.