Skills shortages fuel demand for cyber security services

A shortage of skilled workers could also pose a security problem for smaller companies. Medium-sized companies are increasingly asking for external IT security services. Among other things, a new ISG study cites the major shortage of IT security specialists as the cause.

According to the ISG Professionals Study, the submarket for identity and access management (IAM) is also making a comeback. It is currently being revitalized by digitalization topics such as the Internet of Things. In total, the new ISG provider comparison examined the capabilities of over 80 providers in six market segments.

The topic of IT security is also increasingly becoming the focus for medium-sized companies because cybercriminals are increasingly targeting SMEs. Since the attackers also primarily exploit users' careless behaviour, for example in phishing attacks, user advice and training play a central role.

Added to this are legal requirements such as the General Data Protection Regulation (GDPR). Their implementation still represents a major challenge for many medium-sized companies.

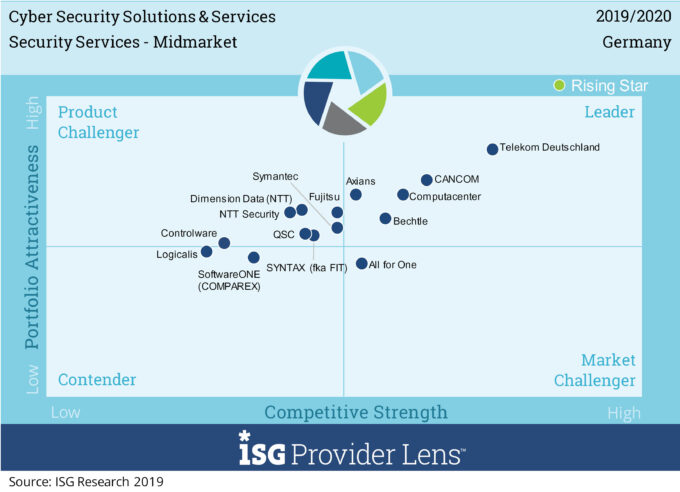

The "ISG Provider Lens™ - Cyber Security Solutions & Services Germany 2019/2020" examined the capabilities of 15 providers in the market segment "Security Services - Midmarket". Current leaders in this market are Bechtle, CANCOM, Computacenter and Telekom Deutschland. Axians is also newly represented in the leader quadrant.

Identity & Access Management

In the market for Identity & Access Management (IAM), the ISG study records rising demand again thanks to digitalization after a phase of stagnation. For example, in the Internet of Things, not only users and their identities need to be protected, but also machines, other devices and company divisions. Only if their identities are secured can digital systems be reliably networked with each other. This goes hand in hand with the fact that the number of users, devices and services is increasing rapidly, and with it the number of digital identities. Against this background, ISG expects that the IAM market will continue to develop dynamically in the future.

Data Loss/Leakage Prevention (DLP)

As private end devices are increasingly used for business purposes, companies must additionally secure their data against unwanted outflow. Companies are faced with the challenge that these end devices are beyond their direct control and, in some cases, may not even be monitored operationally for data protection reasons. The leading DLP providers take these restrictions into account when it comes to control, without at the same time allowing security gaps, according to the ISG study. With the General Data Protection Regulation (GDPR) in force since the end of May 2018, the importance of DLP solutions has increased once again.

network security

When it comes to protecting against cyber attacks, the leading network security providers have now rethought their approach: the starting point for all considerations is now the assumption that the attacker is already in the company's own network. This creates entirely new requirements for network security. These are covered by all the leaders in the corresponding quadrant of the ISG study. The providers differ primarily in the performance of the solution, their respective price-performance ratio, the management of their solutions, their presence in the German market and the functional strength with regard to certain types of attack, such as ransomware attacks.

Cloud & Datacenter Security

According to ISG analysts, the implementation of the General Data Protection Regulation (GDPR), which has been in force since May 2018, has a direct impact on cloud and data center security. This is because companies must expect penalties, some of which are draconian, if personal data is lost. Against this background, compliance guidelines must also be monitored and adhered to. Today's vendor solutions therefore comprehensively monitor the physical and virtual infrastructure in the cloud and in the company's own data center. They detect attacks in real time, block them and log them in a tamper-proof manner.

Security Services - Large Accounts

The security services market for large enterprises is highly competitive. The new ISG Provider Lens™ examined 20 providers operating in the German market in this segment alone. International experience and a broad range of solutions are a must in this market segment. According to ISG, large customers expect providers to have internationally operating teams, but also security operations centers (SOC) with a German location that complement the internationally distributed SOCs. In addition, providers are benefiting from the General Data Protection Regulation (GDPR), which has been in effect since 2018 and continues to create a need for additional consulting and action.

The "ISG Provider Lens™ - Cyber Security Solutions & Services Germany 2019/2020" is available for "ISG Insights™" subscribers as well as for immediate individual purchase at this Website available: https://research.isg-one.com/reports/Quadrant-CSSS-Germany-2019-2020-DE.