Willis Risk Summit 2025: Risk management in times of global uncertainty

With a mix of market analyses, AI strategies and case studies, the second edition of the "Willis Risk Summit" in Zurich addressed current challenges in risk management. The order of the day is to analyze, model and structure risks while excluding the improbable.

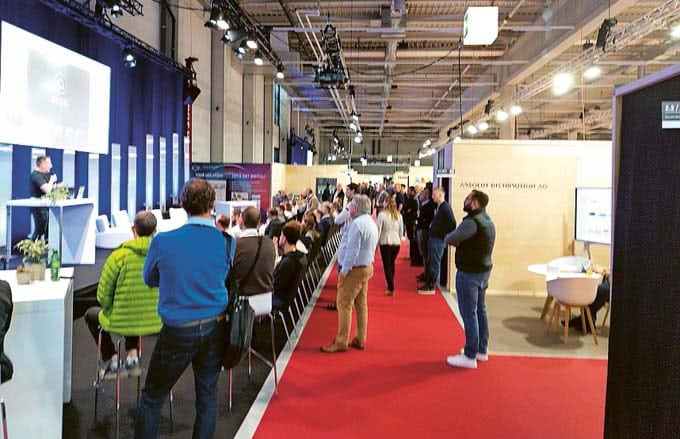

In April, risk consultant and industrial insurance broker Willis, a division of WTW, organized its Risk Summit in Switzerland together with the Swiss Association of Insurance and Risk Managers (SIRM). In a current area of tension - and in the same week that US President Donald Trump's new US tariffs are putting the global economy under pressure - the event aimed to offer participants concrete market orientation and the opportunity to exchange ideas. Kilian Manz, Head of Corporate Risk & Broking Switzerland at Willis, made this clear in his opening speech. This is more important than ever in times of global uncertainty, because: "You never know how fast the world is turning," said Kilian Manz.

Strategically bringing risks to the market instead of just insuring them

Right at the beginning, Hugo Wegbrans, Head of Corporate Risk & Broking Western Europe at Willis, set a clear tone: "Sell your risk to insurers - adapt it to your needs instead of the other way around". In a market that is currently characterized by an increased appetite for risk on the part of disciplined reinsurers and sufficient capacity, among other things, companies have new scope. Risks should be structured in a targeted manner and individual solutions negotiated. In his global market overview, Wegbrans emphasized that the risk landscape is becoming increasingly complex due to factors such as natural disasters, political uncertainty - especially, but not only in the USA - and social inflation. In this environment, tailor-made solutions and a strategic dialog with insurers are needed.

AI for decision-making in risk management: thinking like Sherlock Holmes

Another aspect of the event was the use of artificial intelligence for decision-making in risk management. Prof. Dr. Andreas J. Zimmermann from ETH Zurich, with whom Willis has been cooperating for several years, introduced a new approach in his presentation: Companies need to take a detective approach like Sherlock Holmes - not hoping for pinpoint forecasts, but analyzing probabilities and systematically ruling out the improbable. Zimmermann showed how AI helps to make reliable decisions even with incomplete information through scenario modeling and structured risk assessment.

In addition to geopolitical risks and the use of AI, specific specialist topics were also on the agenda: Dr. Benjamin Schumacher from the law firm "Nater Dallafior" highlighted aspects of liability law and the relevance of precise contract formulations in the event of damage in a case study. Arne Jägers-Weinberg, Head of interRisk Consulting & Engineering at Willis, addressed proactive risk management with a focus on business interruption analyses and emergency planning. The program was rounded off with a presentation by Martin Hotz and Yann Krattiger from Swiss Re Corporate Solutions, who provided practical insights into the use of parametric and structured insurance solutions.

Source: wtwco.com