Economic crime: It's not just cyberattacks

According to PwC's Global Economic Crime and Fraud Survey 2022, 46 % of companies reported being victims of fraud, corruption or other economic crimes in the past two years.

Current environmental, geopolitical, financial and social influences are creating a risk landscape for businesses that is more volatile than ever. These changes are creating gaps that criminal actors are exploiting with increasingly sophisticated attacks, such as the "Global Economic Crime and Fraud Survey 2022." shows. In other words: White-collar crime is no longer limited to cybercrime.

Expensively paid security holes

The study results show that crime rates remain stable at a high level. Just under half of the companies surveyed (46%) reported that economic crimes had been committed against them in the last two years. Among companies with annual sales of around CHF 10 billion, the figure was as high as 52%. The impact within this group was significant: almost one in five large companies reported a loss amount of just under 50 million Swiss francs. The proportion of smaller companies defrauded (i.e. with sales of less than 100 million Swiss francs) was lower (38%), of which one in four suffered a total loss of around one million Swiss francs.

Economic crime: cybercrime remains number 1 threat

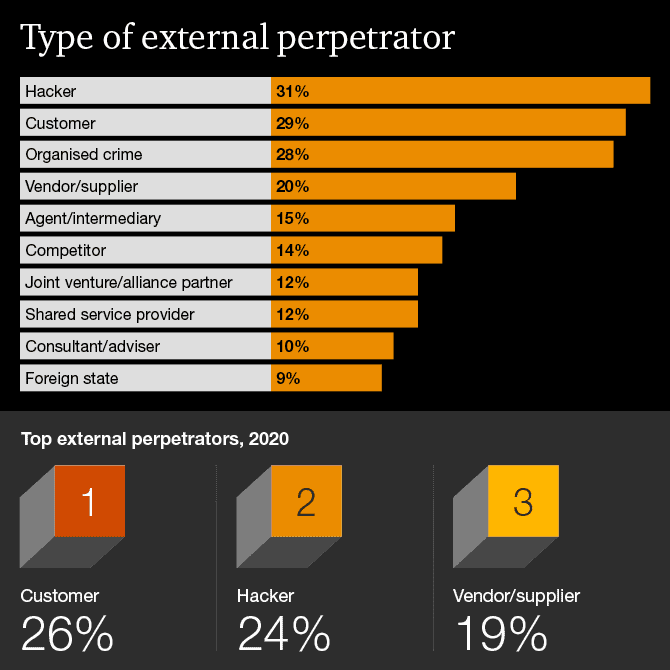

The growing number of digital platforms such as social media and e-commerce opens the door to numerous white-collar criminals - around 40% of those affected experienced some form of platform fraud. Across all company sizes, cybercrime topped the list by a wide margin, ahead of customer fraud (2020 rank 1). 42% of large companies reported being a victim of cybercrime in the past two years. 34% were targeted by customer fraud - fraudulent practices related to products or services (e.g., mortgage fraud, credit card fraud). Asset misappropriation ranked third among the top offenses with 24%.

Combating economic crime across all sectors

Gianfranco Mautone, Partner Forensic Services and Financial Crime Leader at PwC Switzerland, explains: "If cybercriminal attacks are not stopped, they can act as a door opener for numerous forms of white-collar crime. Cyber risks and other forms of fraud are often tackled by separate departments that don't collaborate or share risks - and that's exactly what criminals know. It's imperative that companies find new ways to encourage collaboration among previously isolated departments and identify risk scenarios across functions."

Future threats require well-armed companies

Emerging risks may take on an increasingly important role in the coming years. Currently, only 6% of the organizations reported that they have been victims of anti-embargo fraud (participation in unauthorized boycott measures by other countries). However, this may change in the next two years as global sanctions are at record levels right now. 8% of affected companies recorded ESG reporting fraud (i.e., falsification of ESG disclosures) As ESG continues to grow in importance, criminals may have an increased incentive to commit more crimes in this area. The COVID-19 pandemic also changed the risk landscape: As a result of the pandemic, one in eight companies experienced instances of supply chain fraud for the first time.

Source: PwC