Insurance industry: digital investments on the rise

The consulting firm Colombus Consulting has published the 5th study edition on the digitalization of the customer experience in the Swiss insurance industry. After a tentative upswing in 2021, the insurance industry will invest more dynamically in 2022. There are numerous initiatives aimed at improving the customer experience, especially in mobile applications. Innovation will equally take place through the development of InsurTech and the creation of new business ecosystems.

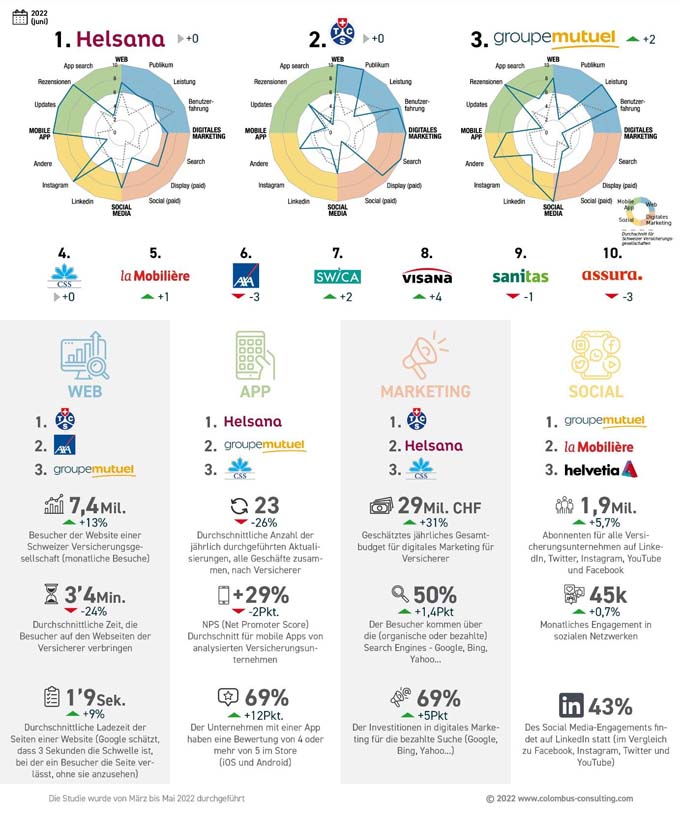

The Digitization accelerates: Insurers Helsana, TCS and Groupe Mutuel, which dominate the ranking, are making more progress on average than the other market players. This is because customer relationships are more developed and interactions are more frequent with more digital services (scanning and sending invoices, changing deductibles, applying for new additional products, asking about product coverage, etc.). This is the conclusion of Colombus Consulting's study on the digitalization of the Swiss insurance industry. Furthermore, the budgets allocated to digital media have increased significantly (+31%), especially among health insurers, who invest more than property and casualty insurers (10 points difference lies in the growth of digital media budgets between the two types of insurance).

Insurers develop their target groups and services

According to the study, the trend is moving in the following directions: The insurance industry is looking to embrace instant messaging, chatbots and better integration of social networks into customer service, as well as develop differentiated interaction services. "The goal for insurers today is to make customer relationships more fluid on digital channels, without forgetting that agencies and advisors remain the main point of contact for customers. We're talking about a digitally enhanced advisor," says Rémi Chadel, associate director of Colombus Consulting.

Mobile apps are at the heart of innovation in the industry

While mobile apps have in the past offered functions that covered basic needs (claims management, scanning of bills, contact with the insurance company), this offering is evolving: SWICA, CSS, Sanitas and Helsana now offer digital health coaching via more advanced mobile apps. The new Twint+ service, in partnership with Würth Financial Services, offers travel insurance or insurance for everyday items in the "app only" market, while Revolut travel insurance is only available in Europe and not in Switzerland.

Continued growth of InsurTech drives the insurance industry

Despite a slowdown in fundraising, InsurTech players are experiencing sustained growth in 2022. At the European level, the sector is divided into two families: on the one hand, companies positioning themselves as direct competitors of traditional insurers (e.g., the German company Wefox and the French companies Alan and +Simple), and on the other hand, providers of specialized services and solutions (e.g., the French company Shift Technology, specialized in fraud detection, and the English company Envelop Risk, specialized in reinsurance). Similar to AXA Switzerland, which bought the start-up Kinastic in 2022, the acquisitions or partnerships between insurers and InsurTech continue.

New ecosystems take shape

The dynamism of InsurTech players has pushed insurance companies to innovate, leading to the emergence of a new trend: Business ecosystems that allow players from the same sector to join forces to create new services. Thus, we note the arrival of Well, a merger of CSS Insurance, Visana, the telemedicine provider Medi24 and the online pharmacy Zur Rose, which offers new integrated services between companies. In the same dynamic, insurers Groupe Mutuel, Helsana and Swica are joining forces in Compensana, along with healthcare groups Medbase and Hirslanden. They are expected to launch services that will also be closely scrutinized by the market. "Customer expectations in the insurance sector are indeed high, as the digital customer experience often lags behind other sectors," says Rémi Chadel.

Should digitalization be achieved through "Open Insurance"?

Through the integration of new services, partnerships and the creation of ecosystems, the insurance market is becoming increasingly open. While in the past, collaboration between companies was aimed at expanding the range of services offered, today Open Insurance should provide the opportunity to offer new end-to-end services or even integrate players from outside the industry. "Excellent experiences for customers and employees remain a powerful driver for innovation in a market that is constantly looking for new ways to do things," concludes Rémi Chadel.

Source and further information: Colombus Consulting